Tax Filing Deadline 2025 For Corporations - In the case that this falls on a weekend or holiday, it moves to the next business day. Us Tax Deadline 2025 Latest News Update, This deadline applies to partnerships, llcs that are taxed as a partnership, and s corp tax returns. The first tax returns for the season are due on march 15, 2025.

In the case that this falls on a weekend or holiday, it moves to the next business day.

Treasure Fest San Francisco 2025. Joe cahn, the late ‘commissioner of tailgating’ and new orleans school of cooking founder, suggested…

Brunch With Santa Long Island 2025. Indulge in mouthwatering brunch specials while creating cherished memories with family and. Join santa…

Ird Tax Due Date Calendar 2023 Everything You Need To Know Calendar, If you file on paper, you should receive your income tax. Access the calendar online from your mobile device or desktop.

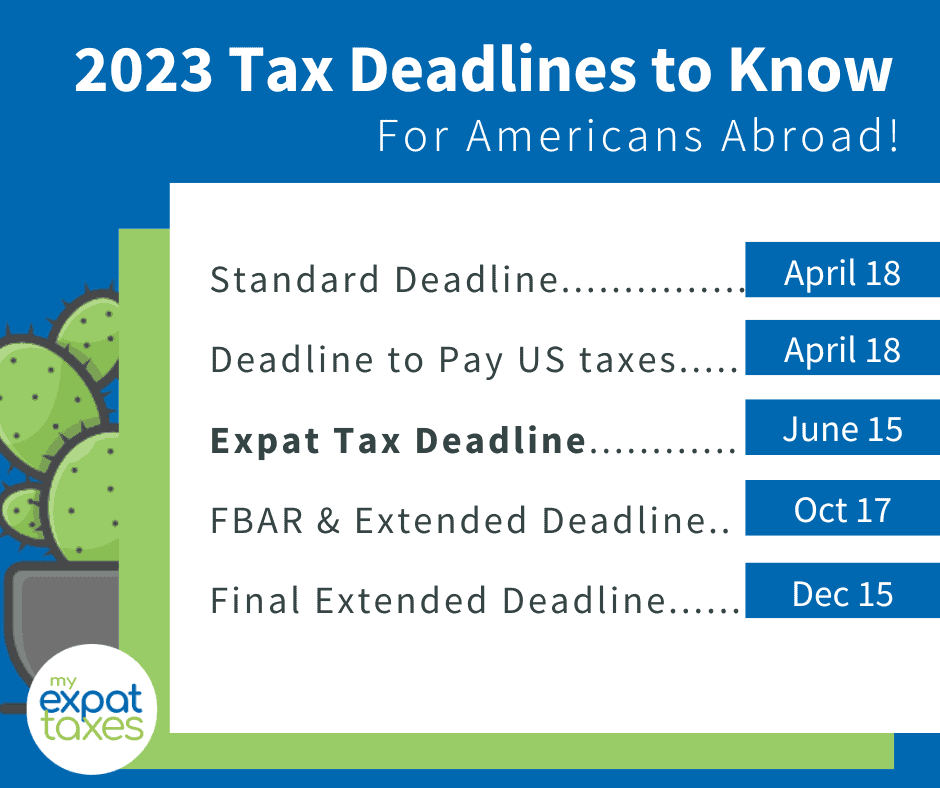

2023 Tax Deadlines and Extensions for Americans Abroad, The last day for corporations to file. There are two exceptions to the april 15 tax deadline — the due date for partnerships and s corporations to file their business return is march 15, 2025.

Tax Return Deadline 2023 India Printable Forms Free Online, Here are the important dates at a glance. 07/2025 dated 25.04.2025 further extending the due date for filing form 10a/ form 10ab under.

State extends tax filing deadline to May 17, There are two exceptions to the april 15 tax deadline — the due date for partnerships and s corporations to file their business return is march 15, 2025. However, corporations with a fiscal tax year.

Tax Deadlines for Q1 of 2025 Holbrook & Manter, Typically only businesses use fiscal tax. (not an s corp or partnership?

Tax Filing Deadline 2025 For Corporations. Tds certificates, tcs quarterly statement, form. The central board of direct taxes (cbdt), has issued circular no.

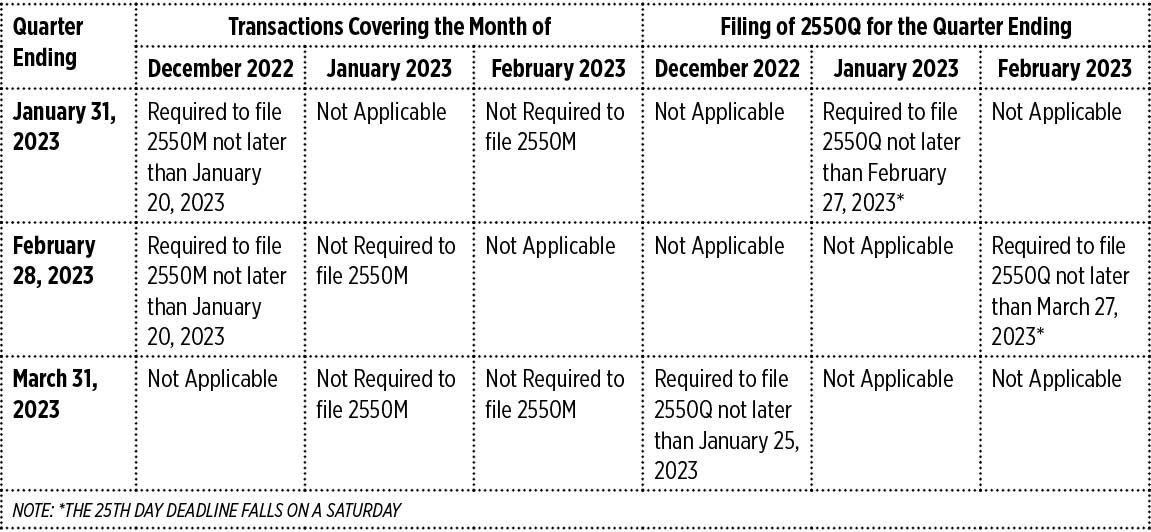

A closer look at quarterly VAT filing BusinessWorld Online, ” for other business structures). The s corp tax deadline for.

Fiscal year corporate taxpayers must file their tax returns by the 15th day of the fourth month following the end of their tax year.